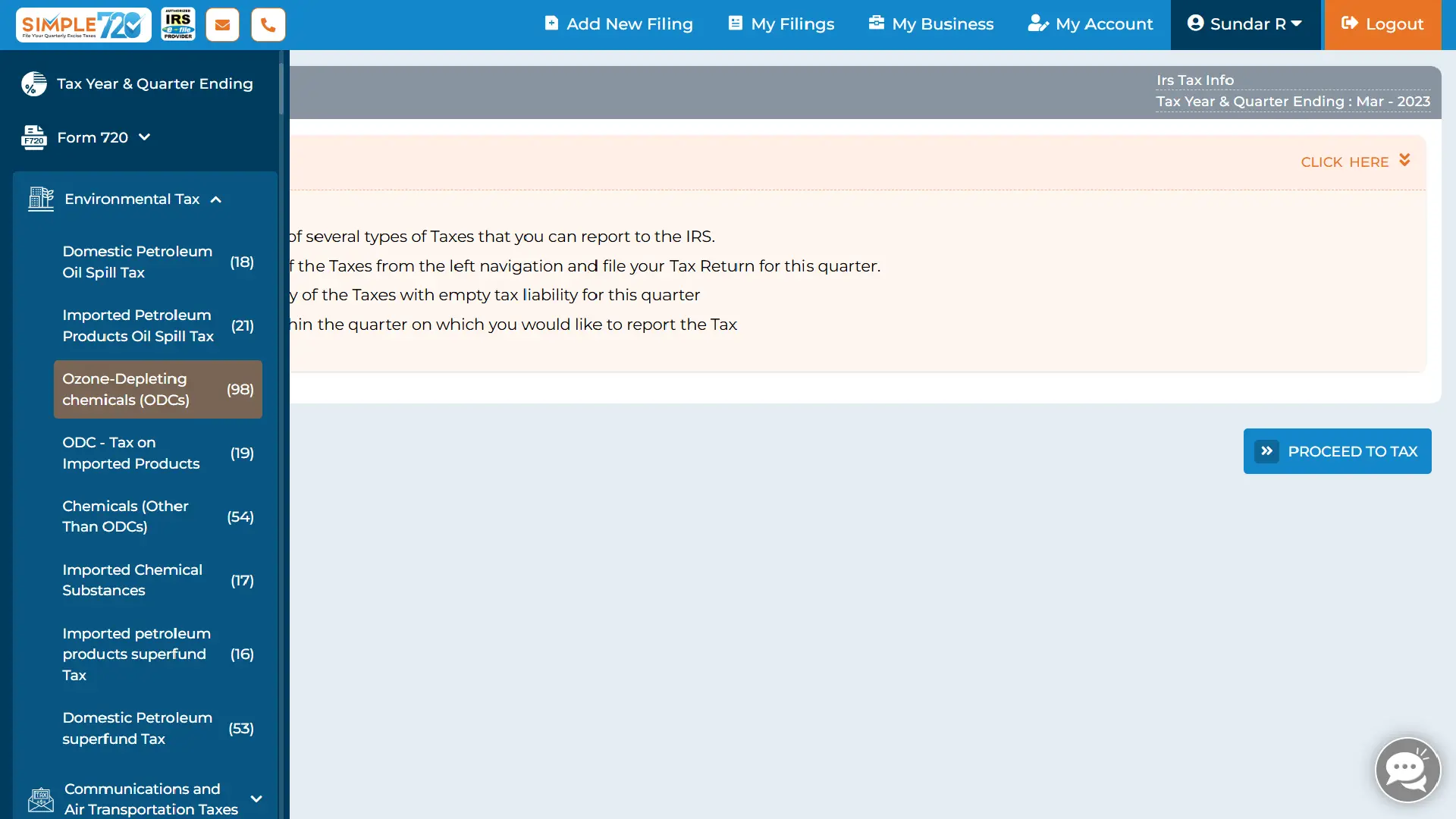

Federal excise tax is a tax imposed on specific goods, services, and activities that are harmful to the environment. It applies to items such as fuel, chemicals, alcohol, and services like air transportation and heavy vehicle use. Businesses that manufacture, sell, or use these taxable goods and services are required to file Form 720 to report and pay excise taxes.

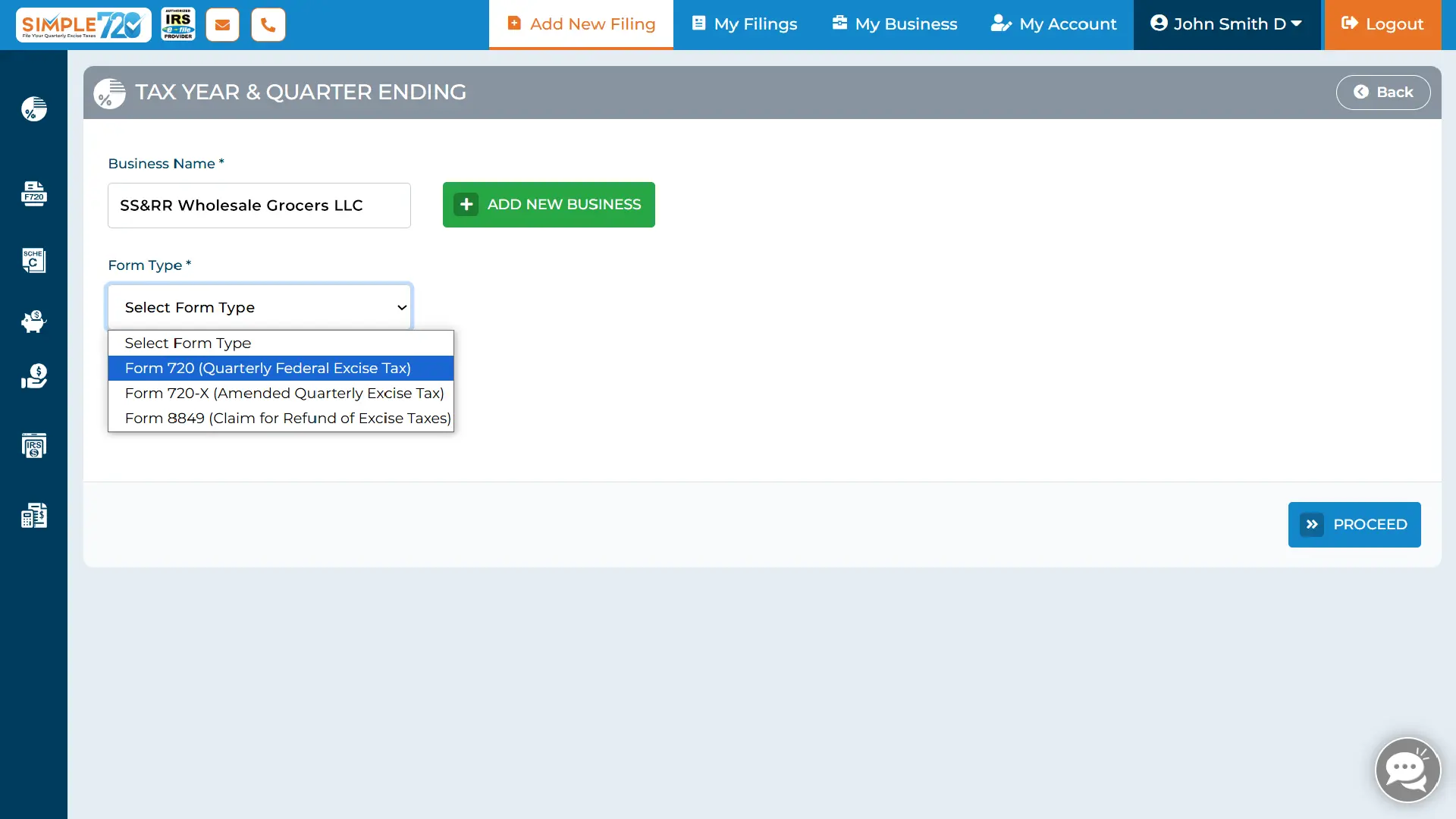

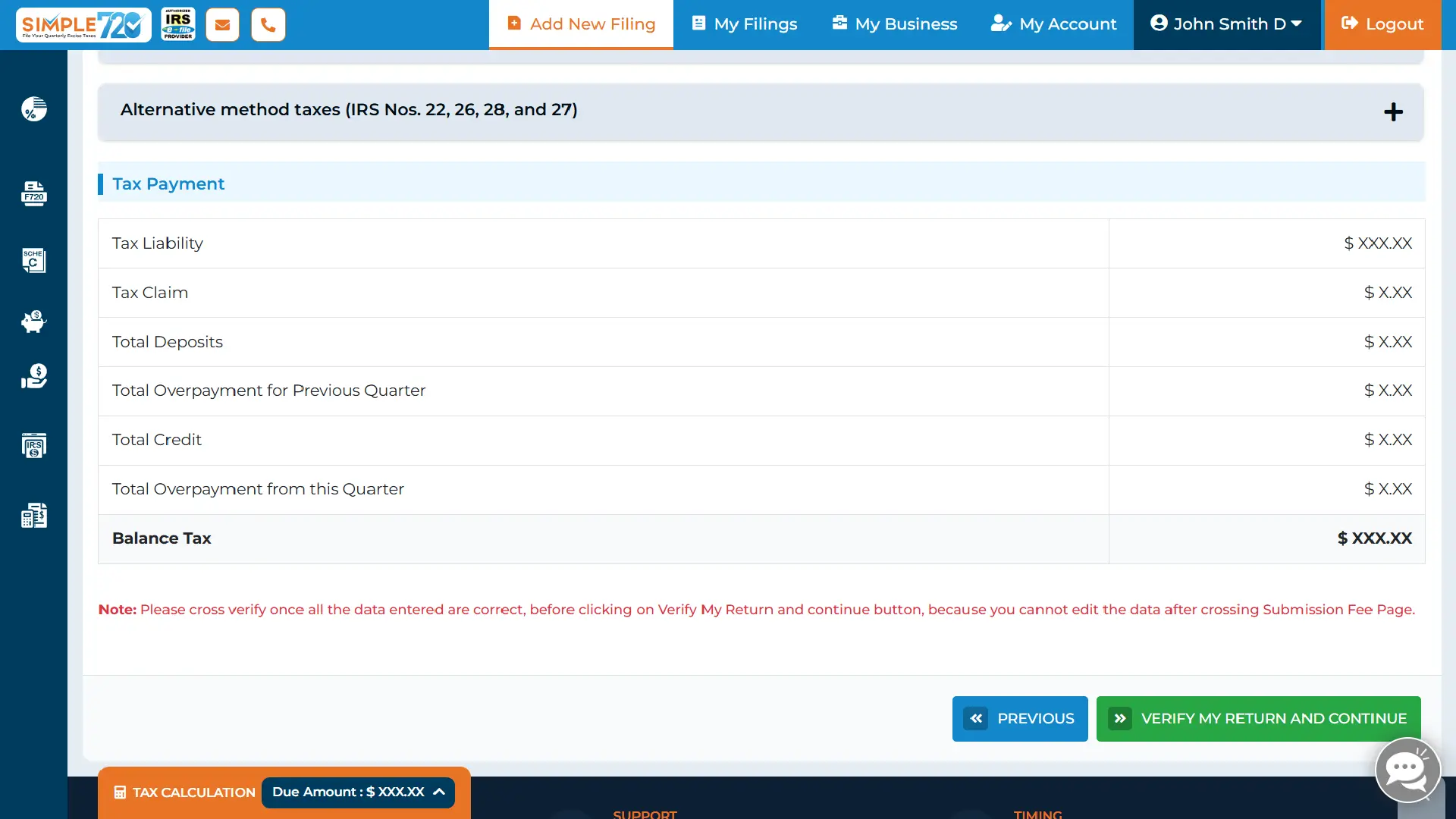

Form 720, commonly referred to as the Quarterly Federal Excise Tax Return, is used to report and pay federal excise taxes across a variety of categories, including PCORI, Tanning Taxes, Truck Excise Taxes, Environmental Taxes, Communications and Air Transportation, Fuel Taxes, Repurchase of Corporate Taxes, and more. Businesses liable for these Federal Excise Taxes must file this tax form quarterly. Each quarter comes with its filing deadline, making timely and accurate submission essential for maintaining IRS compliance and avoiding penalties.