Does your business need to file Form 720?

If you have to pay federal excise taxes for your business, you must be aware of navigating the crafty tax avenue to ensure taxation compliance. How do you even get started with this? If you are unsure of how to get this done, don’t worry.

We have all the information you need about the process of filing Form 720. In this guide, we'll walk you through every aspect of IRS Form 720, the Quarterly Federal Excise Tax Return.

What is IRS Form 720?

The federal government imposes excise taxes on specific types of products and services, like the state sales taxes in some sense. What you might not realize is that you are already paying these taxes, as they are typically incorporated into the prices of goods and services, like the gasoline you pump into your car.

As the excise tax cost is embedded in the price, the responsibility falls upon the seller or manufacturer to remit these tax payments to the federal government and duly file Form 720.

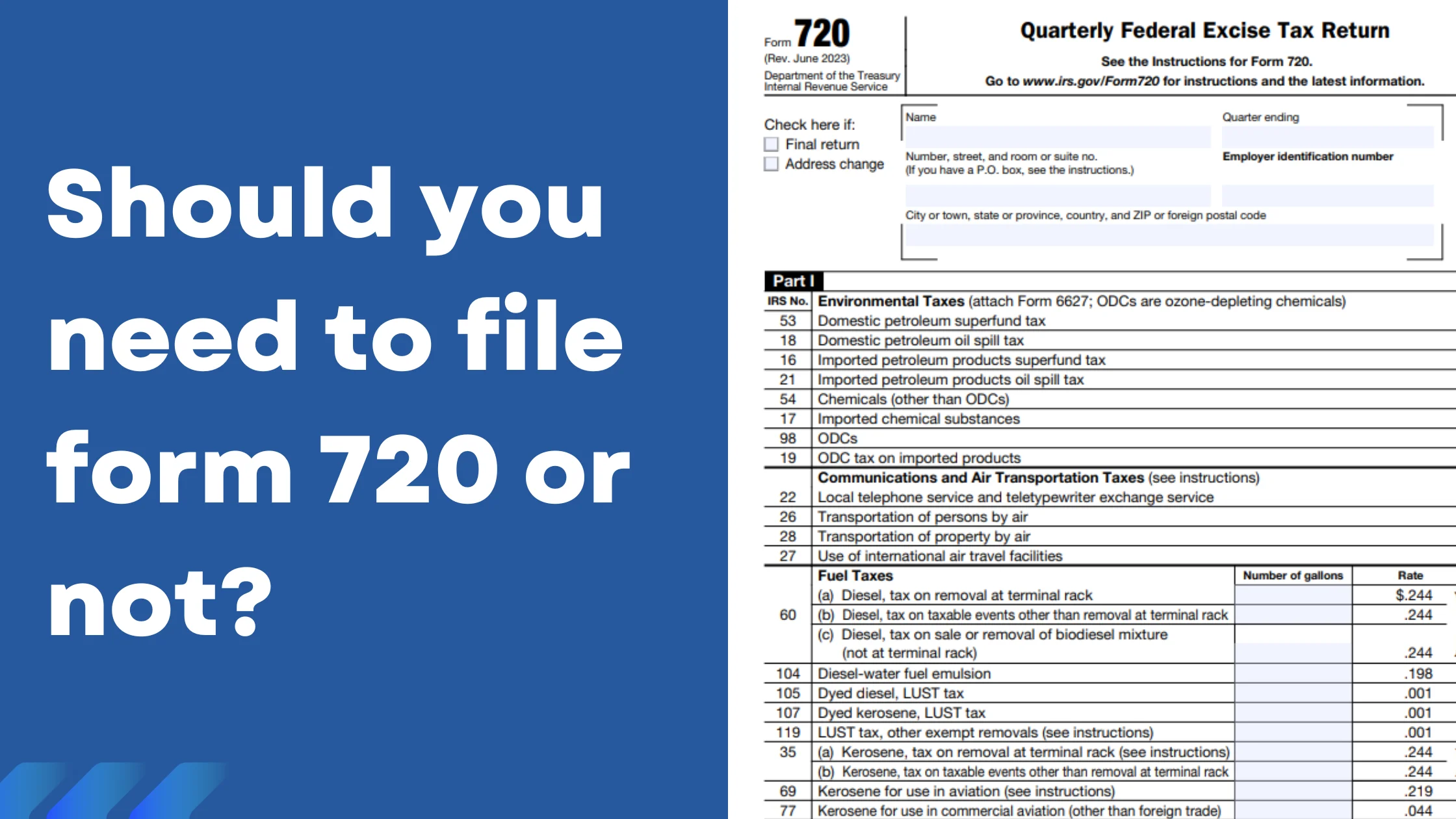

IRS Form 720 which is officially known as the Quarterly Federal Excise Tax Return, is a crucial tax form designed for businesses that sell goods or services that are subject to excise tax. The primary purpose is to allow businesses to report and pay the federal excise taxes that they owe to the IRS. This form is structured such that there are three main parts, along with Schedule A, Schedule T, Schedule C, and a payment voucher known as Form 720-V.

Should you need to File Form 720 or not?

You must be wondering whether your business is required to file IRS Form 720. If your business sells goods or services that are subject to excise taxes, you should file this form. The list of products and services that incur excise taxes is extensive and includes items such as telephone communications, air transportation, gasoline, coal, fishing equipment, indoor tanning services, and more. Form 720 provides a detailed list of these.

There are two specific conditions outlined by the IRS that determine whether you need to complete Form 720:

- If you had a previous quarter's liability or responsibility for collecting any federal excise taxes listed on Form 720, Parts I and II, and you haven't submitted a final return.

- If you are currently liable for or responsible for collecting any federal excise taxes listed on Form 720, Parts I and II, for the current quarter.

However, the excise taxes for alcohol, tobacco, and firearms are not covered under IRS Form 720. These are regulated by the Alcohol and Tobacco Tax and Trade Bureau, and taxes for these products must be filed using the return form on their website.

When to file it?

Essentially, every quarter spans three months. It commences on January 1st of each year, and the form is due on the last day of the month following the quarter's end. For instance, for the quarter ending on March 31st, you must file Form 720 by April 30th.

If your business is paying excise taxes for communications or air transportation, you do have the option to pay as per the instructions dictated in Form 720 instructions.

If you wonder, where to File Form 720 this quarter then this guide will help you.

Navigating Form 720

Form 720 features a dedicated line for each type of excise tax you may be liable for. Most excise taxes are calculated based on unit sales or weight. For example, certain types of diesel fuel incur a tax of approximately 24 cents per gallon. To complete this section, simply input the quantity of gallons sold and multiply it by the applicable rate per gallon.

The Wrap

Understanding tax liabilities can be hard. But we hope this read made this process a little bit easier. Ensuring your business is tax-compliant is mandatory. By getting to know the nuances of this form, you can easily fulfil your taxation obligation. Just be aware of the dates and keep the necessary documents with you, this should make everything sail smoothly. If excise taxes are relevant to your business, then mastering IRS Form 720 is crucial for optimizing business cash flow decision.

Looking for a Form 720 filing partner? Then, File your Form 720 Online today with us!