About Form 8849

What is Form 8849?

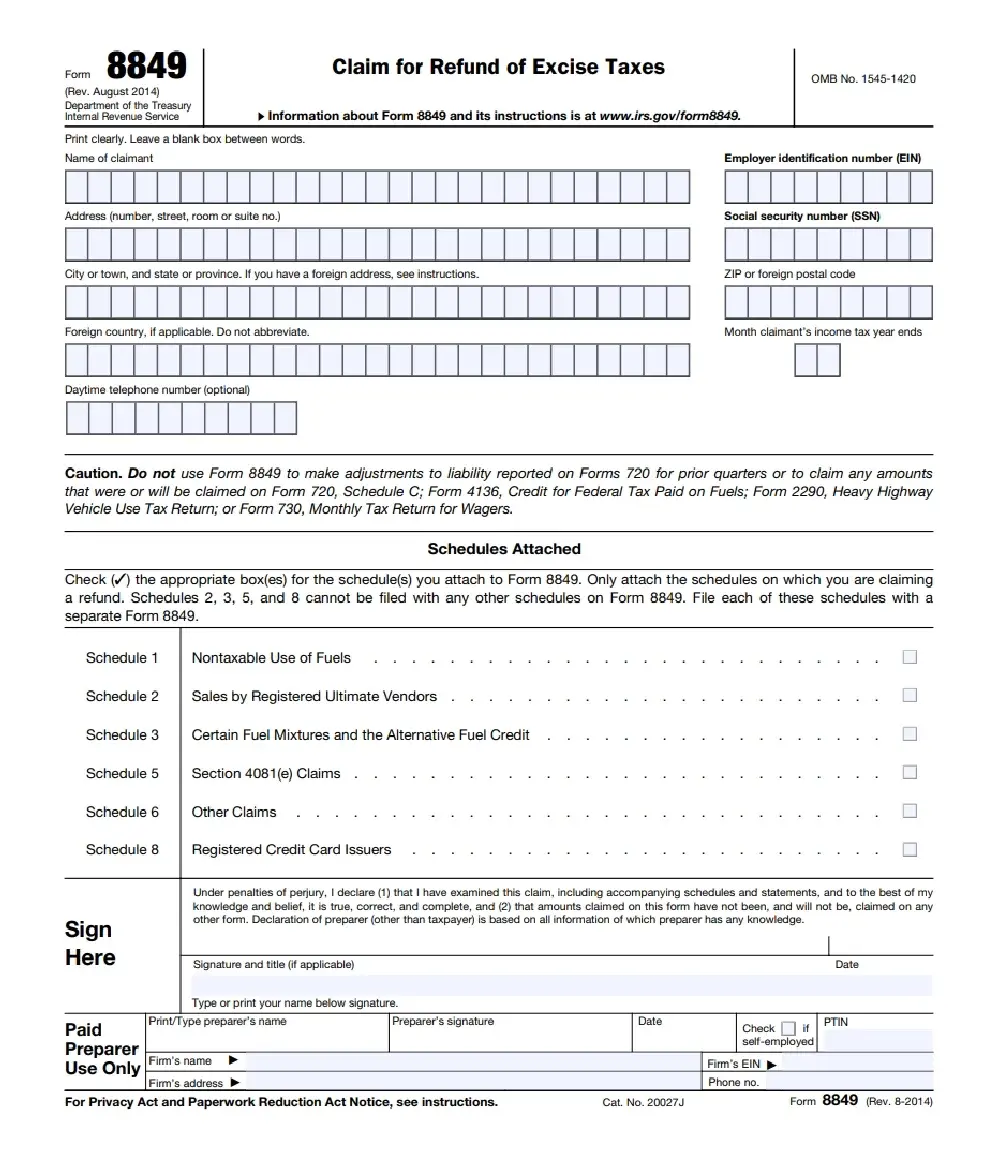

- Form 8849 : Claim for Refund of Excise Taxes

Form 8849 is used to claim refunds for excise taxes paid on certain goods and activities, such as fuel used in non-taxable situations or overpaid taxes. It includes various schedules to report different types of refunds, including Schedule 1 for fuels and Schedule 6 for other claims. Taxpayers must complete the relevant schedule and submit it with supporting documents. The form helps recover overpayments and reduce tax burdens. - Who Is Eligible to File Form 8849?

Form 8849 can be filed by individuals, businesses, and tax-exempt organizations that have paid excise taxes on qualified goods or activities and wish to claim a refund. Eligibility depends on the type of claim being filed and the specific schedule used. Generally, ultimate purchasers, registered vendors, producers, and sellers of alternative fuels can file this form if they meet IRS requirements.

Form 8849 Schedules and Their Purposes

Form 8849 consists of multiple schedules, each covering specific claims:

General Instructions for Form 8849

Complete each schedule and attach all information requested for each claim you make, generally including the following:

- EIN (or SSN) on each attached schedule

- Period of the claim

- Item Number, Rate

- Number of Gallons

- Amount of Refund

How to Claim Form 8849?

To claim a refund using Form 8849, you must select the correct schedule relevant to your claim.

There are two methods to file:

- Download Form 8849 and the applicable schedule. For example, if filing for an HVUT refund, include Schedule 6.

- Complete the forms accurately and mail them to the official IRS address.

- Use an IRS-approved e-filing portal to complete and submit the form online. This method is quicker, more efficient, and recommended by the IRS for faster processing and fewer errors.

How long does it take to get refunds?

According to the IRS, refunds for electronically filed returns are typically processed within 21 days.

For paper-filed returns, processing may take four weeks or more.

Frequently Asked Questions

For Schedules 1 and 6:

Department of the Treasury

Internal Revenue Service

Cincinnati, OH 45999-0002

For Schedules 2, 3, 5, and 8:

Department of the Treasury

Internal Revenue Service

Cincinnati, OH 45999-0002

Form 8849, Claim for Refund of Excise Taxes, is used to request refunds for specific excise taxes, particularly those related to fuel. For example, Schedule 1 of Form 8849 allows ultimate purchasers to claim refunds for nontaxable uses of fuels like gasoline, diesel, and kerosene.

Additionally, Schedule 6 can be used to claim refunds for excise taxes reported on other forms, such as Form 720, Form 2290, Form 730, and Form 11-C. It's important to note that Form 8849 is not intended for claiming income tax refunds; instead, it specifically addresses refunds of excise taxes paid for certain uses or sales.

To amend Form 8849, follow these steps:

- Complete a New Form 8849 : Fill out a new form with the corrected information, including any required schedules.

- Attach a Statement : Include a brief statement explaining the error in the original filing and the corrections made.

- Submit the Form : Mail the corrected form and statement to the appropriate IRS address for Form 8849.

Since there’s no formal amendment option, this process corrects any errors or omissions.

Yes, you can check the status of your refund for Form 8849. Here’s how:

For Online Filings:

If you filed through an IRS-approved online portal, you can check your refund status within the portal.

Processing Time:

- Refunds for Schedules 2, 3, or 8 are processed within 20 days of IRS acceptance.

- Refunds for other schedules may take up to 45 days.

For Manual Filings:

If you mailed Form 8849, processing takes longer, typically 4 weeks or more.

For further inquiries, you can contact the IRS with your filing details.