About Form720

IRS Form 720

Know Your Taxes – Understanding Federal Excise Tax!

Federal excise tax is a tax imposed by the U.S. government on specific goods and services that are manufactured in or imported into the country. Unlike sales tax, which is typically added at the point of sale, excise taxes are often included in the price of the product. Common examples of goods subject to excise tax include gasoline, alcohol, tobacco, and certain environmental and transportation-related products. These taxes are used to fund various government programs and services.

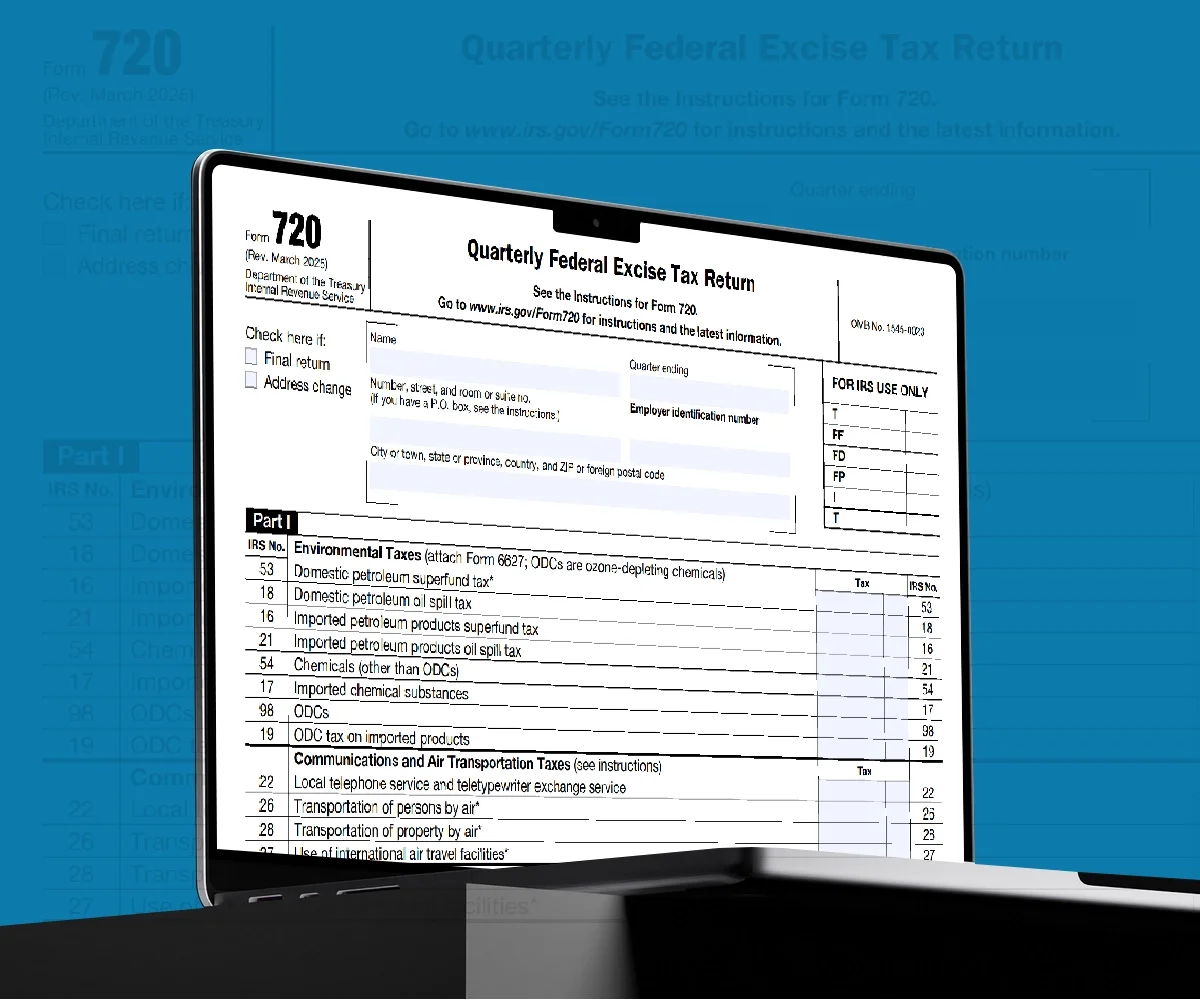

Form 720

Quarterly Federal Excise Tax Return

Form 720, also known as the Quarterly Federal Excise Tax Return, is an IRS tax form that businesses must file every quarter to report and pay federal excise taxes. The form consists of three main parts and includes additional schedules such as Schedule A, Schedule T, and Schedule C, which help businesses report different types of excise taxes.

Schedules in IRS Form 720

Form 720 Due dates

Businesses subject to federal excise taxes must file IRS Form 720 on a quarterly basis to remain compliant. The due dates for each quarter are outlined below. If a deadline falls on a weekend or federal holiday, the filing must be completed on the next business day.

- Q1 (Jan-Mar) : Due by Apr 30

- Q2 (Apr-Jun) : Due by Jul 31

- Q3 (Jul-Sep) : Due by Oct 31

- Q4 (Oct-Dec) : Due by Jan 31

To avoid penalties and ensure timely compliance, businesses should file Form 720 electronically or by mail before the due date.

Where to get the latest version of Form 720?

It’s essential to download the most recent version of Form 720 before filing, as the IRS periodically releases updated versions. To ensure accuracy and compliance, we highly recommend downloading the latest version directly from the official IRS website.

About Form 720Mastering Form 720: Your Complete Step-by-Step Guide

Understanding the key aspects of Form 720 is essential for ensuring a smooth and accurate filing process. Familiarizing yourself with the purpose and requirements of Form 720 helps avoid errors and streamlines submission process. Our Form 720 Instructions page provides detailed insights, including:

- Why Following Form 720 Instructions is Crucial

- Who Needs to File Form 720?

- What is Form 720 used for?

- 720 Online vs. Paper Filing

- How to Manually Fill Out Form 720 According to IRS Instructions

Pro Tips for Filing IRS Form 720 Efficiently

Filing Form 720 can be straightforward if you stay organized and follow best practices. Here are some essential tips to ensure a smooth process:

Stay Penalty-Free: Ensure Compliance with Form 720

Non-compliance with Form 720 requirements can result in significant penalties and interest charges from the IRS. Here’s what you need to know:

- Failure-to-File Penalty:

A penalty of 5% of the unpaid tax is applied per month, up to a maximum of 25% of the total tax due. - Underpayment Penalty:

If excise taxes are underpaid, the IRS may impose an underpayment penalty along with daily accruing interest until the balance is settled. - Electronic Payment Requirement:

Businesses with a quarterly tax liability exceeding $2,500 must make electronic payments. Failure to comply may lead to additional fines.

To avoid these penalties, ensure timely and accurate filing, proper tax calculations, and full adherence to IRS regulations.

Form 720 Final Return

To file a final Form 720, check the "Final return" box above Part I of the form. This is necessary if you're going out of business or will no longer owe excise taxes reportable on Form 720 in future quarters. Ensure all required information is accurately completed before submission

- Speed and Efficiency:

E-filing is faster and more efficient than manual filing. With platforms like Simple 720, you can complete your filing in just a few minutes. - Error Reduction:

Manual filing can lead to calculation errors. E-filing platforms automate calculations, reducing the likelihood of mistakes. - Immediate Confirmation:

E-filing provides immediate acknowledgment upon submission, offering peace of mind that your return has been received.

- Enhanced Security:

Electronic filings are encrypted and password-protected, ensuring that sensitive information remains confidential. - Cost Savings:

E-filing eliminates expenses associated with paper, postage, and manual processing, making it a cost-effective choice.